LAST CALL: The EV charger tax credit ends June 30, 2026.

Federal EV Charger Tax Credits Expire

Please note that the vehicle tax credits have ended. We are keeping this page for archival purposes or those who will be filing their taxes later. If you are curious about what incentives are available, visit PlugStar.com.

Thanks to the Inflation Reduction Act, through Sept. 30, 2025, you could get up to $7,500 tax credit instantly when you bought or leased a new EV. Qualified used EVs may be eligible for up to $4,000 instantly. After the budget bill was signed into law on July 4, 2025, the EV tax credits will not be available for vehicles acquired after Sept. 30, 2025.

What information did you need?

Don’t forget about the federal EV charging infrastructure tax credit. You might qualify to save money on chargers, too, through June 30, 2026.

Tax credit facts | 2025 Webinar | FAQs

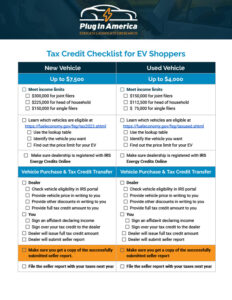

EV Shopper Checklist

To simplify things for you, we created a checklist for EV shoppers who want to get the tax credit on new and used EVs at the time of the sale. Click on the image or button below to download the PDF.

Federal EV Tax Credit Checklist for EV Shoppers

Things to Know About the Federal EV Tax Credits

- The last day for all EV tax credits is Sept. 30, 2025 (this year), and the last day for the EV charger tax credit is June 30, 2026.

- You do not need to have the EV in your possession by Sept. 30, 2025–instead only need to have entered into a contract and made a payment.

- They can be stacked with other state and utility incentives. So, if you and the vehicle you want qualify for a federal tax credit, you can still take advantage of state and local EV incentives. They can really add up!

- Since January 1, 2024, the new EV tax credit and the used EV tax credit are available instantly at the time of sale. (Buyers must still file a tax return even if they don’t normally pay taxes and include the Vehicle Identification Number (VIN) on Form 8936)

- Each vehicle is eligible for one new EV tax credit and one used EV tax credit.

- The EV purchaser must be a taxpayer who is not a dependent of another taxpayer.

- The EV must be purchased for use and not be acquired for resale.

- The EV must have a Gross Vehicle Weight Rating (GVWR) of under 14,000 pounds (except for Commercial Clean Vehicles under IRC 45W).

- The vehicle must have a plug, meaning it must be propelled by an electric motor that draws power from a battery of at least 7kWh and be able to charge from an external source of electricity.

- The EV must be manufactured for use on public streets and have at least four wheels.

2025 EV Tax Credit Webinar

On July 16, 2025, we hosted a webinar that covered everything consumers need to know about the changes to the entire suite of federal EV tax credits and where to find resources.

Resources mentioned

For a list of all vehicles that qualify for the federal tax credit, check these government links:

How to identify eligible Census tracts for the EV Charging Tax Credit

- Find your census tract GEOID on this page.

- See if your census GEOID is listed on this IRS document.

Contact our team of EV experts for one-on-one assistance at support@pluginamerica.org or 1-877-EV Help-1 (1-877-384-3571).

Federal Tax Credit FAQs

We’ve collected commonly asked questions that you access here.

Important: The guidance on this page is for vehicles delivered on or after January 1, 2024. For guidance on other time frames, visit our federal EV tax credit hub.

Plug In America does its best to provide current, accurate information, but we are not tax professionals. Consult your tax advisor to see if you qualify for tax credits.