Qualified USED electric vehicles may be eligible for a tax credit of $4,000 under Internal Revenue Code 25E.

EV Shopper Checklist

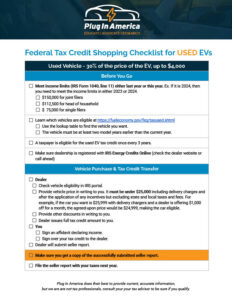

To simplify things for you, we created a checklist for EV shoppers who want to get the tax credit on a used EV at the time of the sale. Click on the image or button below to download the PDF.

2024 Federal Tax Credit Checklist for Used EVs

Used EV Tax Credit Requirements

Vehicle Eligibility

Vehicles must meet all of the following requirements:

1. The vehicle model you purchase must be listed on https://fueleconomy.gov/feg/taxused.shtml

2. The vehicle must have a sale price of $25,000 or less.

3. The vehicle must have a model year at least two years prior to the current calendar year (So for 2024, the vehicle must be model year 2022 or earlier).

4. The vehicle must be sold by a dealer registered with the IRS.

Purchaser Eligibility

You must meet all of these requirements.

1. As the purchaser, you must meet income limits:

- $150,000 for joint filers

- $112,500 for head of household

- $75,000 for single filers

2. A purchaser is eligible for a used EV tax credit once every 3 years.

Tip: Only one taxpayer can claim the tax credit, so if you file jointly, and one of you makes less than $150,000 a year, you may consider filing separately so that the taxpayer who earns less can claim the tax credit.

3. The USED EV tax credit is transferable. This means you get the full amount of the tax credit up front at the time of sale. It also means you can get the full amount of the tax credit without owing taxes.

LEARN MORE ABOUT TRANSFERABLE EV TAX CREDITS

Other Requirements

To know for sure whether the vehicle you want is eligible for the tax credit, a dealer registered with the IRS must look up the vehicle VIN in its portal and confirm vehicle eligibility.

These other requirements must be met to receive the clean vehicle tax credit:

- The vehicle must be purchased for personal use, not for resale.

- You can’t be the original owner of the vehicle.

- You can’t be claimed as a dependent on someone else’s tax return.

- The vehicle must be primarily used in the U.S.

- Each vehicle is only eligible for the tax credit once, so once it is transferred to a qualified buyer in a qualified sale after August 16, 2022 (even if the tax credit isn’t used for the sale), the used vehicle is no longer eligible for the tax credit.

- The dealer must report the required information to you at the time of sale and to the IRS.

- Businesses, nonprofits, and fleets cannot receive the used EV tax credit.

Used EVs That Qualify for the Clean Vehicle Tax Credit

The Department of Energy has created a list of qualifying vehicles with their MSRP caps. Please note this link is different from the new EV link.