The total cost of owning an electric vehicle changed on Oct. 1, 2025. That’s when no one could use the federal tax credits for new clean vehicles (a.k.a. 30D in the federal tax code), used clean vehicles (25E), and commercial clean vehicles (45W). These tax credits were designed to lower the upfront cost of EV purchases through 2032, and their early termination is likely to have a big impact on the EV market in the immediate future. However, there are still so many benefits of driving an EV that will never go away. EVs can be super easy to charge at home, fun to drive, and are better for the environment.

The total cost of ownership for a vehicle (also known as a TCO analysis) includes not only the upfront cost of the vehicle but also the maintenance, insurance, fuel, and registration costs that a driver can expect to pay every year. With the end of the tax credits and other recent market and policy changes, it’s worth revisiting this total cost and taking a deep dive into each category.

Calculating the total cost of vehicle ownership

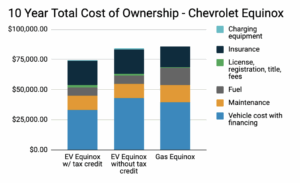

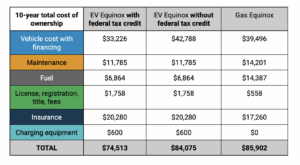

For this analysis, we compared the gas and electric versions of the 2025 Chevrolet Equinox LT. These two cars are nearly identical, except for their fuel source, making them good for comparison. We also calculated the total costs for an EV with the tax credit for new clean vehicles (30D), which gave buyers a credit of $7,500 towards a vehicle purchase.

The bottom-line findings: The EV purchased with the tax credit had the lowest total cost, the EV purchased without the tax credit had the next-lowest cost, and the gas vehicle was the most expensive to own.

Each section below explains our methodology and the changes impacting each category.

The vehicle purchase cost

More than 80% of new car purchases are financed, so we included financing in our calculations. We assumed a loan duration of 5 years, an interest rate of 10%, and a down payment of 20%. Some automakers offer financing deals, and an interest rate of 5% could save the EV driver up to $4,000 on financing costs. We also assumed a sales tax of 7.6%, consistent with the national average. We used formulas from PlugStar.com to calculate the amount due at signing and the monthly loan payment.

The loss of the new vehicle tax credit greatly increased the financing cost for an EV, raising it above the cost of financing a gas vehicle. However, our financing cost did not include any non-federal incentives. There are still opportunities to take advantage of state and local purchase incentives. Additionally, many manufacturers are cutting prices or continuing to offer a $7,500 price reduction on many EV models through the end of 2025. Ask your dealer about the latest deals! Tariffs will very likely have an effect on new vehicle prices soon, regardless of drivetrain, but it’s unclear what the exact effects will be.

Vehicle maintenance

Over 10 years, the owner of the EV would save about $2,416 in maintenance costs compared to the gas car. We used AAA’s Your Driving Costs to calculate the maintenance costs for each car and assumed that it is driven 12,200 miles per year, the national average in 2023 according to KBB. EVs are cheaper to maintain because they have fewer moving parts and fewer fluids to replace. The battery can last 20 years or more, and the motor and electronics require little to no regular maintenance. This leads to fewer repairs needed and lower maintenance costs overall.

Car insurance

The EV owner in this scenario would pay about $3,360 more in insurance costs over 10 years. We again used AAA’s Your Driving Costs to find a yearly estimate for full-coverage insurance for an EV and compact SUV. EVs can be more expensive to insure than gas cars if they have a higher MSRP, requiring a higher level of insurance. And although EVs have fewer moving parts that require repairs, if the car ever needs to be repaired, it might need specialized parts that are shipped from other states. These increased insurance costs might be growing pains of the early EV market and could decrease over time.

Registration and additional fees

License and title fees are the same for both cars, so we estimated $90 for the initial registration year. We estimated $52 for registration each year after that, based on state averages.

However, in many states, there are additional fees that EV drivers have to pay for registration or charging. This is because gas cars contribute to state and federal highway revenue through gas taxes, while there is no equivalent fuel tax for EVs (although EV drivers pay into the system in other ways). The federal tax on gasoline has not been raised since 1993, which is partially why our transportation funding is lagging behind. In some states, the revenue from EV taxes goes towards charging infrastructure. There have also been recent proposals at the federal level to add hefty EV fees.

The National Conference of State Legislatures tracks EV and hybrid fees in each state, and we estimated an annual EV fee of $120 from this data. EV drivers pay more in road user fees than gas car drivers pay in gas taxes in at least 32 states, according to Atlas Public Policy. EV drivers want to pay their fair share for transportation funding, but these fees should not be punitive, as many of them are right now.

Electricity costs

When it comes to fueling up, EV drivers almost always have a financial advantage. Over 10 years, it costs more than twice as much to fuel a gas car as to charge an EV, for a total savings of $7,523 for the EV driver. We used an average residential electricity rate of about 17 cents per kilowatt-hour. We also assumed that 12% of charging occurred at public charging stations at an average rate of 48 cents per kilowatt-hour. Drivers who use public charging more often would pay more in fuel costs, since public charging electricity rates are higher than residential rates.

Residential electricity costs have risen in recent years due to increased load from AI data centers and air conditioning, decreased incentives for renewable energy generation, and the repeal of funding appropriated for grid upgrades. Gasoline prices are also artificially low, since the U.S. pays around $31 billion annually in direct fossil fuel subsidies, much more than any subsidies for renewable energy. Gas prices today don’t reflect these subsidies or the negative societal costs of fossil fuels, such as air pollution, which contributes to and exacerbates health issues like asthma.

Electricity and gasoline costs vary greatly by state. The Zero Emission Transportation Association’s ‘Electricity vs Gasoline Calculator’ breaks down fuel savings for an EV versus a gas car. These annual savings can range from 13% to over 60% depending on the state, using the Chevrolet Equinox as an example. Overall, EV drivers pay much less on average to fuel their vehicles, which gives EVs a major cost savings advantage in this category.

10 ways EV drivers can keep saving money

There are many ways that EV drivers can keep reducing their daily costs. Here are 10 of our favorites:

- Consider buying a used EV – buyers are getting great deals!

- Look up EV purchase and charging incentives available from your utility, state, and city. These incentives are easy to search on PlugStar.com.

- See if your vehicle manufacturer or utility offers discounts on charging equipment.

- If you live in multifamily housing, look for incentives that might cover the cost of installing charging at multifamily properties from your state, city, or utility.

- Charge at home if you can, and consider using a Level 1 or low-power Level 2 home charger to meet your daily needs.

- Use free public chargers, which are easy to search for on PlugShare.

- Find out if your workplace offers free or low-cost EV charging.

- Learn about managed charging options from your local utility, and take advantage of time-of-use rates to save money during peak periods.

- Install vehicle-to-building or vehicle-to-grid charging to power your home or get credits from your utility. Many EV drivers integrate solar panels into this system.

- Do your research along the way to get great deals on every purchase and service!

If you can’t currently charge at home, there are still ways to save money with an EV. You can advocate for right-to-charge policies in your state or city, which will give drivers who live in condos, apartments, or HOAs the right to install charging stations if they meet baseline requirements. Drivers don’t have to pay the installation costs by themselves; many states, cities, and utilities offer incentives for charging installation at multifamily housing. Although charging at home has the highest cost-saving potential, many utilities, municipalities, companies, and organizations are working to make charging more affordable and accessible for everyone. Explore our Affordable and Convenient Access to EV Charging Toolkit for additional cost-saving projects and ideas nationwide.

EVs are here to stay, and there is still so much potential to save money while driving an awesome car.