If you lease a vehicle, the lessor (company that maintains the vehicle title) is the original user. This means that they will claim and receive the tax credit, but they can pass it along to the lessee (you, the customer) in your lease payments. When negotiating your lease terms, simply ask if they are willing to lower your deposit or monthly payments in an amount equal to the tax credit. The lessors receive the tax credit through the Commercial Clean Vehicle Tax Credit.

By: Lindsey Perkins

|

Published: 02.28.2024

Can I get the tax credit by leasing a new clean vehicle?

Related Articles:

By: Alexia Melendez Martineau

|

Published: 11.14.2024

NEVI Funding: Tracking the build-out of America’s EV charging network

More and more EVs are on the road every day, and public charging is rapidly scaling up. While most charging is done at home, drivers need public fast charging to support long-distance travel and enable consumers who don’t have access to home charging to make the transition to electric vehicles.[…]

By: Alexia Melendez Martineau

|

Published: 10.30.2024

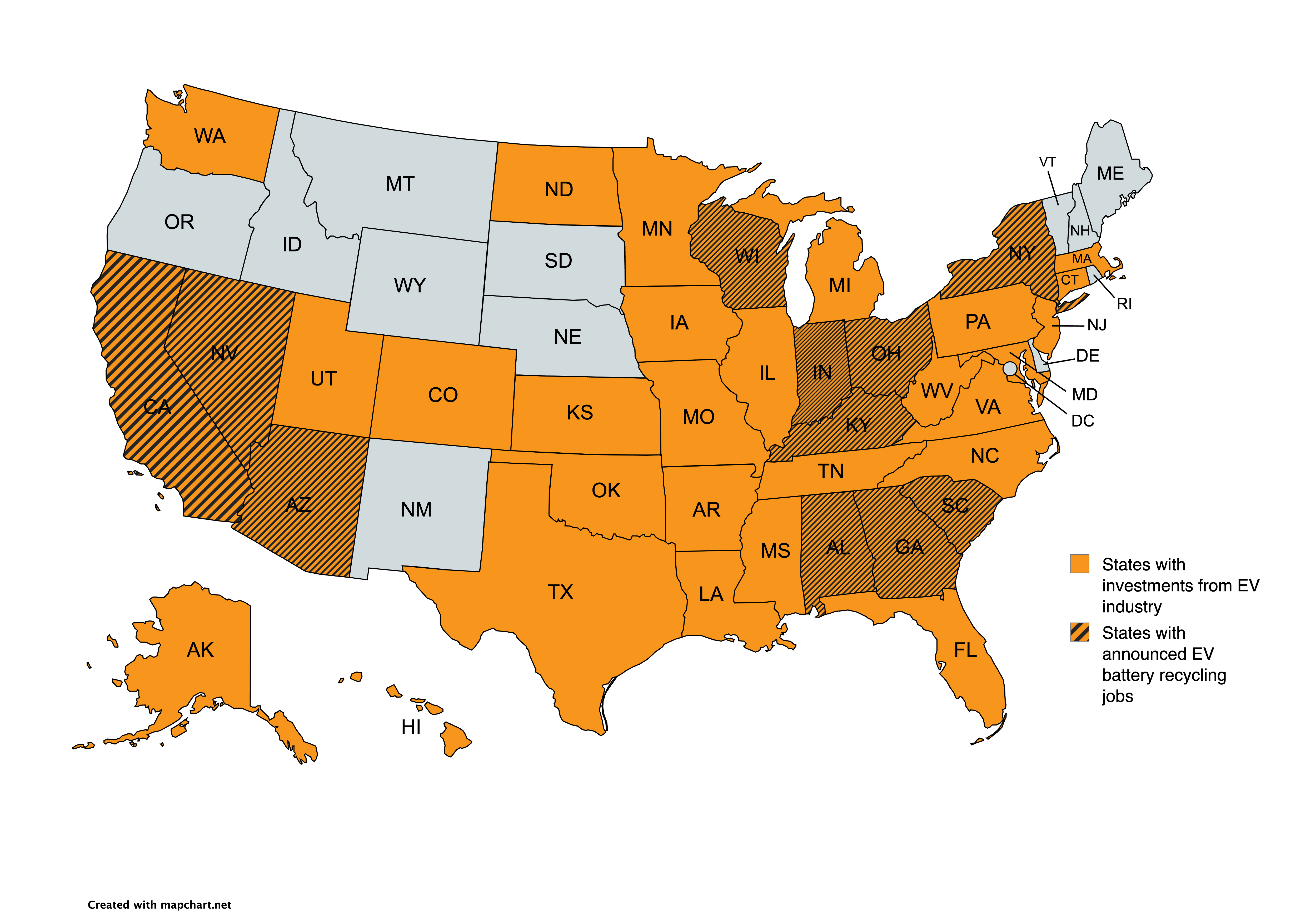

More EVs in the U.S. equals more jobs in the U.S.

The transition to electrified transportation is here, and the Biden-Harris Administration’s Investing in America Agenda is accelerating progress. The agenda includes legislation like the Bipartisan Infrastructure Law (BIL) and the Inflation Reduction Act (IRA). This legislation supports activity across the EV industry, including $7.5 billion for the roll-out of 500,000[…]