It’s that time of year again–long days and warm temperatures signal it’s time for the great American road trip. As drivers embark on cross-country adventures, we take for granted miles of open roads.

But who pays for these roads? You do, every time you pull up to the pump. States rely on gas taxes to fund road improvements and repairs. Since electric vehicles (EVs) don’t use gas, they don’t contribute to this fund. As EVs become more popular, states are developing new approaches for how to pay for roads. No matter what we drive, we all want smooth roads and safe bridges.

Plug In America believes that EV drivers should pay their share in a way that is fair. Here is our recommended 3-step process to guide states in funding highways.

Step 1: Identify Revenue Replacement Baseline

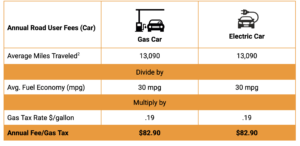

Since all states have a gas tax in place, let’s not recreate the wheel. To develop a baseline of what an average vehicle pays, you can use the average annual Vehicle Miles Traveled (VMT) in your state and divide it by the expected fuel efficiency of a passenger vehicle. This provides us with how many gallons of gas a vehicle will need to purchase each year. We then multiply the number of gallons of gas needed each year by the gas tax rate per gallon. This gives us an estimate of what a vehicle should contribute in annual fees.

For example, in Figure 1 we look at a 30 mpg sedan in Arizona. Based on average annual miles traveled, the estimated fuel economy, and the gas tax rate, we can determine that the average car in Arizona contributes about $82.90 a year in gas taxes. We think the average EV should pay the same. This is our baseline.

Figure 1: Replacement Revenue for a 30 mpg Car in Arizona

Step 2: Address Funding Gaps

Many states are already experiencing shortfalls for highway funding, primarily because cars have become more fuel efficient and because gas taxes aren’t indexed to inflation. To address these, state legislatures can adjust gas taxes to make up funding gaps and index them to inflation. If the gas tax goes up, EV road user fees will go up the same amount, ensuring equitable contributions from both fossil-fuel and electric vehicles. Indexing fuel taxes to inflation allows state legislatures to “set it and forget it” so that they do not have to keep changing gas tax rates.

Step 3: Customize Road User Fees

This is the part where states can express their individuality and customize their EV road user fees to align with state policy goals and take advantage of existing mechanisms. There are dozens of approaches states can take. Here are a few of our favorites:

- Decrease vehicle miles traveled: For states that have annual safety or emissions inspections, it’s easy to capture odometer readings during this time. By simply dividing the annual fee by the average vehicle miles traveled, we can create a per-mile fee. Mileage-based user fees create an incentive to drive less.

- Incentivize smaller vehicles: Not all vehicles are created equal. A full-size pickup truck and a subcompact car create different amounts of wear and tear on the roads. The “average mileage” identified in step 1 can be tied to vehicle weight or to EPA size class. This incentivizes people to drive smaller, lighter, more efficient cars.

- Make EV fees more progressive: Transportation can be a disproportionate energy burden for low-income households. Gas taxes are regressive, meaning they take a larger percentage of income from low-income groups than high-income groups. Since EV fees in this recommendation are based on gas taxes, they are also inherently regressive. States interested in reducing wealth disparity and promoting equity can scale road user fees based on income or waive the fees for low-income drivers.

Every state in the nation collects gas taxes to help pay for transportation infrastructure. As more EVs take to the roads, we propose a process to create a fair and sustainable way to fund highways, roads, and bridges regardless of fuel type. Road user fees can be adjusted from this baseline to make up for funding deficits and support state policy priorities. To read Plug In America’s full position on EV Fees, click here.